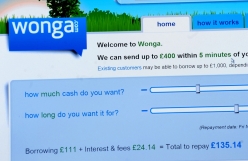

The Church of England has cut all ties with Wonga, after facing criticism for its investment in the payday lender's portfolio.

The Church Commissioners for England released a statement which reveals "indirect investment exposure to Wonga...has been removed".

"The Church Commissioners no longer have any financial or any other interest in Wonga," the statement adds, noting that the Church hasn't made any profit from the relationship, and has never invested directly in a payday loan company.

The statement also underlines that the Church has already made several changes to its ethical investments, and will be putting further controls in place in the future in line with suggestions from the Ethical Investment Advisory Group.

"The Commissioners' focus remains the mission they share with the Archbishop of Canterbury – supporting the ministry and growth of the Church of England," the statement continues.

"The Commissioners will also continue to seek ways, consistent with their fiduciary duties, to support the Church's priority of promoting responsible credit and savings. In 2013 they provided £200,000 of start-up capital to the credit union the Church itself is establishing, the Churches' Mutual Credit Union.

"As active stewards of their investments the Commissioners will continue to engage with financial services companies to encourage responsible credit and savings practice."

This announcement has been welcomed, given the propensity of payday loan companies, perhaps most notoriously Wonga, to prey on low-income individuals and families – encouraging short-term loans with huge hidden charges and astronomically high interest rates.

"I'm absolutely delighted," Edward Mason, Secretary to the EIAG, told Christian Today.

"The EIAG has long been considering the issues of investment in pooled funds, their place in ethical investment and the controls around that, and the national investing bodies have now received that advice.

"We're really pleased that a solution has been found to enable the Commissioners to eliminate their investment in Wonga."

Mason will in fact be taking up a new role as Head of Responsible Investment at the Church Commissioners to take forward the implementation of ethical investment policy.

Wonga was also recently condemned for sending out fake letters, supposedly from law firms, to frighten debtors into paying up more quickly.

Archbishop Justin Welby attacked unscrupulous loan companies for such behaviours last year. He was left embarrassed, however, when it was discovered just 24 hours later that the CofE's pension fund had a £75,000 investment in Accel Partners, a company which acts as a financial backer for Wonga.

Welby has since promised to "compete you [payday lenders] out of existence" and has been vocal in advocating credit unions as a local, ethical and affordable alternative. He has actively encouraged Christians to invest in such schemes, and has also set up a Task Group on credit unions, chaired by former Chief Executive of the FSA, Sir Hector Sants.

The Archbishop insisted credit unions will "help serve all the people of this country better and...contribute to developing a more transparent and competitive system focussed on serving the needs of everyone".

Christian Today contacted Wonga for a response, but was told "we're not commenting on what is a Church matter".