Companies that fail to respond to the concerns of churches and others over the impact of their business on the environment will suffer serious damage to their reputations, a leading consultant in the field has warned.

Ben Caldecott, who leads Oxford's Stranded Assets programme which studies how environment-related risks affect assets, said that when organisations such as the Church of England announced divestment policies, it was not the action of selling shares that had the biggest impact.

He warned that he "indirect effect" of divestment has the most significant impact, with the business practices of organisations exposed to additional scrutiny and potentially resulting in damage to their reputations.

"Church groups, faith groups, are very influential still, even in an increasingly secular society," he told BBC Radio 4's Sunday programme. "It poses a significant reputational risk to some of these companies."

He was speaking after the Church of England announced a £12 million divestment from thermal coal and tar sands, meaning it is ending its financial investments in fossil fuels that are the heaviest pollutants.

None of the Church's three investing bodies, including the Church Commissioners, who are responsible in total for £9 billion worth of assets, will make any direct investments in any company where more than 10 per cent of revenues are derived from thermal coal or the production of oil from tar sands.

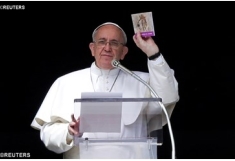

This announcement coincides with a new Church of England climate change policy that sets out how investments will support the transition to a low carbon economy. The Methodists have also announced a new climate change policy, setting criteria for excluding tar sands and thermal coal companies from investments, although not yet threatening divestment. Pope Francis is due to publish a landmark encyclical on climate change, the environment and stewardship.

Canon Richard Burridge, deputy chair of the CofE's ethical investment advisory group, said: "Climate change is already a reality. From an ethical perspective the focus of the investing bodies must be on assisting the transition to a low carbon economy. The Church has a moral responsibility to speak and act on both environmental stewardship and justice for the world's poor who are most vulnerable to climate change. This responsibility encompasses not only the Church's own work to reduce our own carbon footprint, but also how the Church's money is invested and how we engage with companies on this vital issue."

Bishop of Salisbury Nick Holtam, lead bishop on the environment, said: "It marks the start of a process of divestment as well as engagement with fossil fuel companies and better aligns the Church's investment practice with its belief, theology and practice.

"Climate change is the most pressing moral issue in our world. Change is happening rapidly, I therefore particularly welcome the commitment to regularly review the policy recommendations in the light of our knowledge and experience."

Tom Joy, director of investments at the Church Commissioners, said: "We want to be at the forefront of institutional investors seeking to address the challenge of energy transition. This will predominantly be achieved through strategic engagement, as seen by recent shareholder resolutions at Shell and BP. But this new policy rightly goes beyond to incorporate investment exclusions for companies focused on the highest carbon fossil fuels where we do not think engagement would be productive."

Edward Mason, head of responsible investment for the Church Commissioners, said: "This is one of the most comprehensive policy frameworks on climate change adopted by any institutional investor. This is not about divestment versus engagement. This policy talks to how institutional investors committed to ethical and responsible investment can integrate climate change considerations into their thinking and investment strategy. This is an evolving space. We want to continue to collaborate with others to play our part in the transition towards a low carbon economy and low carbon investing."