In anticipation of Apple Pay's efforts to become international, Google is revving up its mobile finance app. Now, users of Google Wallet have added security in the form of FDIC insurance.

For bank account holders, being insured is one way of securing their money against security breaches, since there are instances that banks fail because of failure in systems. The Federal Deposit Insurance Corporation helps secure each holder's account by protecting funds. For banking institutions, the FDIC insures accounts up to $250,000. The insurance and protection was designed as a safeguard effect from the Great Depression, to make people trust banking institutions again.

However, most mobile finance services fall under the category of "non-banking institutions," and so there are no assurances for credit if somehow the service is disrupted. Also, most mobile services like Paypal and Venmo are just transfer points for money; people just use them to conveniently relocate funds without going to the banks. For people who store money in electronic finance services, their savings would be lost once the service crashes or closes down.

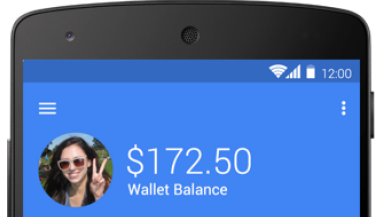

According to Yahoo! Finance, a major change in Google's mobile finance service is for its use to be insured by the FDIC. It is not in the user agreement with Google Wallet, though. However, Google issued a statement to Yahoo! Finance that the current policy has already changed. Google will hold Wallet balances in banking institutions that are insured by FDIC. What it translates to is that now, for those who use Google Wallet and store their money in the Wallet Balance, their funds are now insured by FDIC.

If this is the case, Google Wallet would be the first mobile money transfer and holding service that would be FDIC-insured. True, other mobile and online services like Paypal and Venmo offer some protection with zero liability for users, but there would be no assurances in terms of protecting the funds itself.