The importance of teaching young children about money

If we teach children early on about how to manage money, it will help them to avoid problems like debt later on in life, says Sarah Wallace of the Just Finance Foundation.

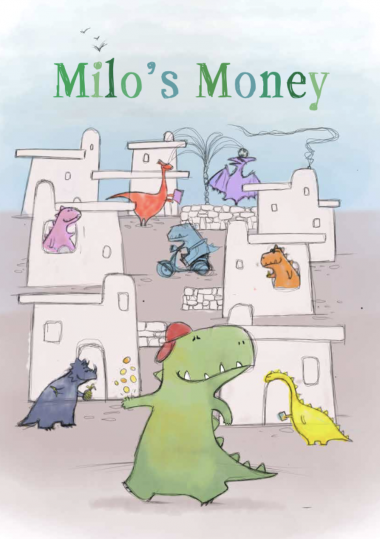

She speaks to Christian Today about Milo's Money, a new school-based scheme to do just that for 5- to 7-year-olds, and why it's not too young to be teaching children about money.

CT: What prompted you to create this resource for children?

Sarah: We already have a programme called LifeSavers for older primary school children, but actually children's attitudes about money are formed by age 7, which is really early, and so we wanted something to help the very young ones understand money and its value. It's about forming healthy attitudes around money that will set them up for the rest of their education.

CT: How can we teach such a young age group about this?

Sarah: We based Milo's Money on a simple storybook about a young dinosaur who earns some money by doing chores for his uncle. He's never had any money before and doesn't know what to do with it so he asks different people and they give him lots of different advice about what he can do. Things like spending it or saving it; pooling it with a friend to buy something to share; buying something for someone who is ill or sad; or growing his money by buying some ingredients to make smoothies to sell. It's then up to the children to make their own decision about what they think Milo should do with his money and why.

CT: Some people might think 5 is too young to be teaching children financial education?

Sarah: It's really important to teach young children about money because these days, most parents pay for things by card and so children don't always understand the finite nature of money. They might just think 'oh, put it on a card; that's how you pay for things', not understanding that there has to be money in the account for them to be able to pay for it! So it's important that they understand coins and their value and what happens when you've spent them and they're gone. It's about bringing all of that into their maths and other lessons.

CT: Sounds like helpful advice for adults too!

Sarah: We know much better now that these attitudes are formed at such an early age but, thinking about the last 30 years, so much else has changed. Children are marketed to as consumers now and there is this drive to get people to buy things they don't need. So it's really hard for young people to resist that when they want to be like their friends and have the same things their friends have.

There are lots of things that can push them into debt and there are now even new ways of being pushed into debt emerging in the form of 'buy now, pay later', and the option to pay for things in three installments.

We need to work hard to instil values at an early age that can help children to avoid problems around money and debt later on.

CT: It's interesting that schemes which on the one hand could be helpful for some people, could also, if not monitored properly, push us into problem debt.

Sarah: Absolutely. With the work we do with teenagers and young people, we're not saying that credit is bad; we recognise that it's really useful for many people. But often, people don't understand the implication of missing payments and how much that could cost them in the long term. So it's a case of using it to your advantage without letting it take over your situation.

CT: What values should we instil in children in terms of how to manage money well?

Sarah: With Milo's Money, we're quite careful to leave it to the children to decide how Milo should spend his money. We present the different options and it's for them to choose.

But the LifeSavers programme for older children looks at money through the lens of wisdom, generosity, thankfulness and justice.

So wisdom would look at ways to be careful with what you do with your money, while generosity thinks about things like how we can use our money to care for the less fortunate.

Justice thinks about what different people earn and asks questions like whether it's fair that some people work and yet are still in poverty. We have Christian resources as a bolt-on for Christian schools that include things for collective worship around money. It can be adapted for a Christian or secular setting.

CT: Milo's Money has been designed for schools but can it also be used for families too?

Sarah: It can be used by families. Actually we tested the book out with families and we got back anecdotal evidence that children wanted to have the book read to them again. The ebook is actually available on our website so if children have been reading it in school or if parents are just interested, they can go online to read the book and register to play the companion game. It's helpful if families reinforce the messages children are taught at school.